An Unbiased View of 501c3

Wiki Article

Little Known Facts About 501c3.

Table of ContentsThe 5-Minute Rule for Irs Nonprofit Search3 Simple Techniques For Google For NonprofitsAll about Non ProfitThe Single Strategy To Use For 501c3 NonprofitThe Ultimate Guide To Non Profit OrgNon Profit Organizations Near Me - An OverviewGetting My Non Profit Org To WorkSome Known Facts About Not For Profit.

Unlike lots of other kinds of giving away (through a phone telephone call, mail, or at a fundraiser occasion), donation web pages are extremely shareable. This makes them suitable for enhancing your reach, and consequently the number of contributions. Donation web pages allow you to accumulate as well as track information that can notify your fundraising strategy (e.The Only Guide to 501c3

donation size, when the donation was made, who donatedThat gave away muchJust how how they exactly how to your website, site) Finally, donation pages contribution web pages convenient and practical as well as easy donors to give!Be certain to accumulate e-mail addresses as well as various other relevant information in a proper means from the start. 5 Take treatment of your people If you have not tackled employing and onboarding yet, no fears; now is the time.

The 20-Second Trick For Npo Registration

Determining on a funding model is essential when beginning a not-for-profit. It depends on the nature of the not-for-profit.As a result, nonprofit crowdfunding is getting the eyeballs these days. It can be made use of for specific programs within the company or a general donation to the reason.

Throughout this action, you could desire to believe about landmarks that will certainly indicate a possibility to scale your not-for-profit. Once you have actually run for a bit, it's essential to take some time to consider concrete growth objectives. If you have not already developed them during your preparation, develop a set of essential performance indications and also milestones for your not-for-profit.

Unknown Facts About Not For Profit Organisation

Without them, it will be difficult to review and track development later on as you will have absolutely nothing to gauge your results against and you will not recognize what 'effective' is to your nonprofit. Resources on Starting a Nonprofit in numerous states in the United States: Starting a Nonprofit Frequently Asked Questions 1. Just how much does it set you back to start a not-for-profit company? You can start a nonprofit company with an investment of $750 at a bare minimum and it can go as high as $2000.How much time does it take to establish a not-for-profit? Depending on the state that you're in, having Articles of Consolidation approved by the state government may use up to a few weeks. As soon as that's done, you'll have to request recognition of its 501(c)( 3) status by the Irs.

With the 1023-EZ form, the handling time is generally 2-3 weeks. 4. Can you be an LLC and a nonprofit? LLC can exist as a nonprofit limited obligation company, nonetheless, it must be totally possessed by a single tax-exempt not-for-profit company. Thee LLC ought to additionally satisfy the requirements according to the internal revenue service mandate for Restricted Obligation Companies as Exempt Organization Update.

Some Ideas on Nonprofits Near Me You Should Know

What is the distinction between a foundation as well as a not-for-profit? Foundations are normally funded by a family members or a business entity, yet nonprofits are moneyed Extra resources through their revenues and also fundraising. Foundations typically take the cash they began out with, spend it, and afterwards disperse the money made from those investments.Whereas, the extra money a not-for-profit makes are utilized as running expenses to fund the company's objective. Is it difficult to begin a nonprofit organization?

There are numerous actions to start a nonprofit, the obstacles to entrance are reasonably few. 7. Do nonprofits pay taxes? Nonprofits are excluded from government earnings taxes under section 501(C) of the IRS. Nonetheless, there are specific circumstances where they may require to pay. If your not-for-profit makes any kind of income from unassociated activities, it will certainly owe income taxes on that amount.

Nonprofits Near Me Things To Know Before You Get This

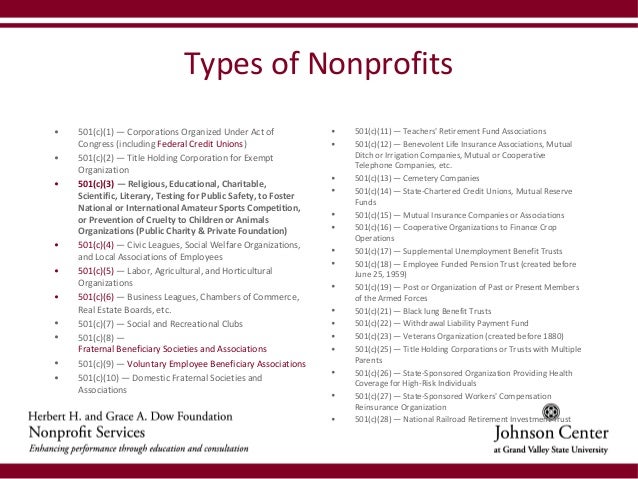

The role of a not-for-profit company has always been to produce social adjustment and lead the method to a far better world. You're a pioneer of social modification you can do this! At Donorbox, we focus on services that aid our nonprofits enhance their contributions. We know that financing is key when starting a not-for-profit.By far the most common type of nonprofits are Section 501(c)( 3) organizations; (Section 501(c)( 3) is the part of the tax obligation code that licenses such nonprofits). These are nonprofits whose objective is philanthropic, spiritual, instructional, or clinical.

This classification is necessary because private foundations undergo stringent operating policies and policies that don't put on public charities. For instance, deductibility of contributions to a private structure is a lot more restricted than for a public charity, and exclusive foundations are subject to excise tax obligations that are not imposed on public charities.

Our 501c3 Nonprofit Statements

The bottom line is that exclusive structures obtain visit their website a lot even worse tax obligation treatment than public charities. The main difference between private foundations and public charities is where they obtain their financial backing. An exclusive structure is commonly regulated by a specific, family members, or firm, as well as acquires a lot of its earnings from a few donors and financial investments-- a fine example is the Costs and also Melinda Gates Structure.Most foundations simply offer money to various other nonprofits. As a practical issue, you require at the very least $1 million to begin a private structure; otherwise, it's not worth the difficulty and expenditure.

The Ultimate Guide To Nonprofits Near Me

If the IRS identifies the nonprofit as a public charity, it keeps this condition for its initial 5 years, regardless of the general public assistance it actually gets browse around here throughout this time. Beginning with the not-for-profit's 6th tax obligation year, it must show that it satisfies the general public support test, which is based upon the support it gets throughout the current year as well as previous 4 years.If a not-for-profit passes the test, the internal revenue service will certainly continue to monitor its public charity condition after the initial five years by requiring that a completed Schedule A be filed each year. Figure out more concerning your not-for-profit's tax status with Nolo's book, Every Nonprofit's Tax obligation Overview.

Report this wiki page